Most Canadian charities operate on a revenue of less than 200K per year

May 22, 2020

6 min read

Getting to know charities in your community, along with their work and their needs, can go a long way towards making a big difference.

Contributing to a donor-advised fund can provide added support to small charities.

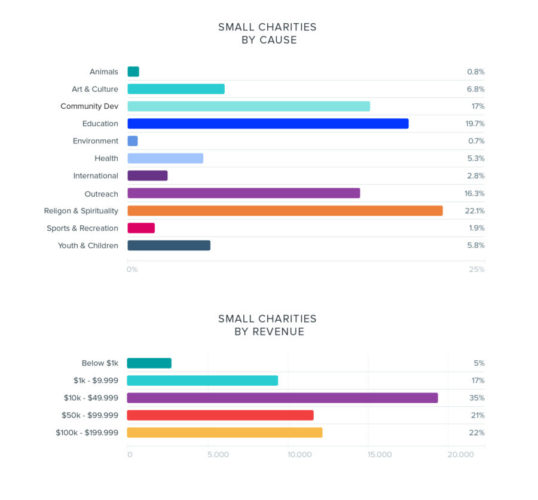

When you think of charities, a handful of big names might come to mind that represent organizations with national and global reach. According to research from Charitable Impact, the majority of Canadian registered charities actually operate on a much smaller scale: 56% have annual revenues of less than $200,000.

Within this group of small charities, most (at 35%) had annual operating revenue of between $10,000 and $49,999. The majority of charities address religion (at 22.1%), with education occupying a close second place at 19.7%. Community and outreach are also often found within this group, at 17.0% and 16.3% of the total.

Our numbers on the prevalence of small charities are consistent with previous findings. In over a decade, there has only been a small shift — from 54% of all registered Canadian charities in 2007 to 56% today.

Small charities’ big role in communities

Small charities may be playing large roles in smaller communities and collectively make a major difference to the economy. In total, all registered Canadian charities contributed to 8.5% of the the country’s GDP in 2017 (more than the retail sector and roughly equal to the mining, oil, and gas extraction industry). Donations claimed on Canadian tax receipts totalled $10 billion in 2018.

Small charities may be facing particular strain as the economic effects of the COVID-19 pandemic can make recruiting volunteers and asking for donations more difficult. According to Imagine Canada, nearly three quarters (73%) of charities they surveyed report donations are down. Nearly half (49%) are reporting difficulty engaging volunteers.

Charities either surviving or struggling

To get a closer sense of how the COVID-19 pandemic has been affecting small charities, we spoke with Charitable Impact’s own Business Development Manager Jeremy Bell. According to Bell, who also founded a small charity, these groups are either surviving or struggling during the ongoing pandemic depending on how they have adapted.

Some charities may be unable to pivot or adjust due to their operating models. Bell started a charity called HomeStart, which typically provides donated furniture to on average 400 to 700 individuals or families per year moving into new homes. Due to public health and safety restrictions, the organization has been unable to collect furniture and donations and is struggling to pay rent on their storage space.

However, he notes certain charities (like small churches) have been successful in maintaining a strong rapport with donors by moving services online. “Charities that are adjusting to maintain contact and continue to build on the relationships with their loyal client base are going to emerge in a better place,” said Bell.

“We will see some charities have to close right now, but I am optimistic and confident that many will reopen. We will need charities, and particularly even more so in the food and housing security spaces, during our recovery from this pandemic,” he said.

Connect with your giving to make a difference

Bell suggests the best thing donors can do at this time is to reach out to charities in their own communities and maintain connections to the organizations most important to them.

“If you can give $100, think about spreading it out between four or five small charities that you know well. That can make a big difference right now.”

Once you have checked in and understand the needs, if you are in a position to donate, small gifts can go a long way. When you feel confident about where to give, think about how you can most optimally donate within your budget. “If you can give $100, think about spreading it out between four or five small charities that you know well. That can make a big difference right now,” said Bell.

Donor-advised funds can facilitate more donations to small charities

Charitable Impact operates as a donor-advised fund or DAF. This means that you can use your Impact Account like a bank account for your giving. Add money, get an immediate tax receipt, then take the time and space to decide where to give.

DAFs offer unique benefits to small charities because they can expand the pool of donations available. DAFs have the capacity to process gifts of large sizes and non-cash assets on behalf of charities who otherwise may not be able to receive such donations. At Charitable Impact, anyone can open an Impact Account with a minimum contribution of $5.

Small changes in habits can create a big impact

Have you ever considered making a monthly or annual giving goal? Taking regular, consistent steps towards your giving goal will help you achieve it.

At Charitable Impact, you can add money to your Impact Account while deciding where you will give. This allows you to set aside funds for donations while you get to know needs in your own neighborhood, town, or city.

Setting up recurring deposits to your Impact Account can empower you to save for giving to charities and causes you care about. This can allow you to make a larger contribution over time, while creating a potentially lifelong habit for charitable giving. Get in touch with us to find out more.