1. Charitable Impact’s Donor-Advised Fund

A donor-advised fund is like a bank account for charitable giving. It’s a tool that provides donors a chance to donate first, then separately make decisions around how they want to use that charitable donation. Furthermore, donated assets can be held in and invested by a donor-advised fund.

Charitable Impact outsources investment management. As an independent donor-advised fund, we work with advisors across financial institutions. This means we allow donors to recommend the advisor and wealth management firm they would like to work with to manage their donated assets. As a result, donors get to work with an advisor they already trust.

We also allow wealth managers to retain management over the assets they help their clients give away, so long as our policies are followed. Your investment management and client relationship expertise is critical to the successful investment of charitable assets.

When you use Charitable Impact’s donor-advised fund, you can seamlessly help your clients fulfill their philanthropic goals without having to be an expert in charitable giving. Plus, you’re able to retain the assets at your firm and continue to deepen your client relationships while taking advantage of our technology-based solution and personalized giving support.

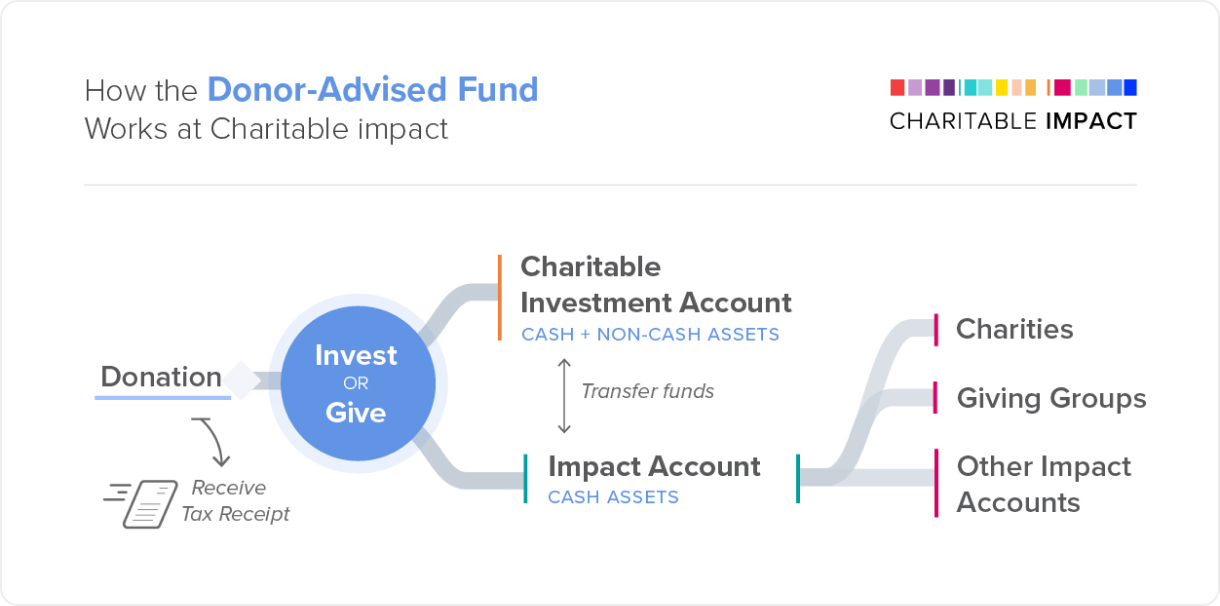

Charitable Impact’s donor-advised fund is made up of two account types that work together: the Charitable Investment Account and the Impact Account.

The Charitable Investment Account is used for longer term investment and management of charitable assets, such as publicly traded securities, private company shares, life insurance, and real estate. Those donated assets can be held at your firm and on your book where you can earn and charge fees. Invested charitable assets grow tax-free and you can continue to manage the donated assets according to our Investment Policy Guidelines.

The Impact Account is used as the day-to-day cash account for making grants to charities and others on Charitable Impact. It is a secure online account held with us.

When your client is ready to make a grant, you simply raise cash by liquidating the necessary amount of charitable assets needed from the Charitable Investment Account. The proceeds are transferred to the Impact Account where your client can then give in a variety of ways.

Making a donation

Clients can donate cash and non-cash assets including publicly traded securities, private company shares, life insurance, and real estate. In particular, when clients donate publicly traded securities in-kind, they benefit from the exemption of capital gains. This additional tax incentive makes donating publicly traded securities more tax effective than donating cash or other assets, all things considered equal.

Regardless of what asset your client chooses to donate, they will receive an immediate tax receipt for the fair market value of their donated assets at the time of donation.

After a donation is made, clients can recommend to invest the charitable assets in a Charitable Investment Account, or liquidate them to the Impact Account to fund more immediate giving interests. More on these two client recommendations in the next section.

Donate & Invest

After their donation, clients can recommend that the donated assets be invested. We refer to this recommendation as Donate & Invest because all or some of the donated assets are retained for investment purposes instead of for immediate grantmaking.

To facilitate Donate & Invest decisions, open a Charitable Investment Account for each client who recommends this course of action. You will be able to manage the account actively or passively with all returns on investment accruing to the benefit of your client’s donor-advised fund with Charitable Impact. Plus, if you’re working with clients who are likely to make recurring charitable gifts, a Charitable Investment Account makes it easier to facilitate your clients’ donations now and in the future. Your client will have already established an account with you, which can be used to invest additional assets or used to liquidate a portion of the assets so that grants can be made from their Impact Account.

Each Charitable Investment Account is an account opened with you at your wealth management firm in the name of CHIMP: Charitable Impact Foundation (Canada). We recommend opening one Charitable Investment Account for each client (or family) so that you can tailor the investment mix to achieve their specific giving goals. All Charitable Investment Accounts must adhere to Charitable Impact’s Investment Policy Guidelines. If you have questions or want to discuss an exception to the policy guidelines, please contact [email protected].

Donate & Give

Not everyone who will enjoy the tax benefits of donating appreciated publicly traded securities, or other assets, will recommend their donated assets be invested. Some clients will want the cash proceeds from the sale of donated securities to be made immediately available in their Impact Account so they can use the charitable dollars to make a grant. We refer to this client recommendation as Donate & Give because clients want to give away the assets they donated sooner rather than later and are not looking for ongoing investment management.

To facilitate Donate & Give decisions, we recommend that you open a transactional account under your management in the name of CHIMP: Charitable Impact Foundation (Canada). Because you will be selling the donated publicly traded securities immediately after they have been received into our account, you will be able to use one transactional account to process donations of publicly traded securities made by any of your clients who have yet to set up a Charitable Investment Account.

In our experience, the Donate & Give approach is the easiest way to begin helping your clients with charitable giving. For example, by simply helping clients to shift their donations of cash to donations of appreciated publicly traded securities, you immediately save them money by making their donations more tax effective (thanks to the capital gains exemption when public securities are donated in-kind). In our experience, many clients start with Donate & Give before evolving to Donate & Invest.